Visit Air China's mobile website/APP

The mobile website/APP offers:

a.Special discounts on domestic flights, which support various payment methods available, including overseas credit cards, WeChat pay, Alipay, etc. (billed in RMB).

b.PhoenixMiles membership benefits. By logging into the Air China APP, you will receive a voucher for a no-questions-asked ticket refund and gain access to services such as check-in, flight updates, self-service rescheduling, and secure ticket purchase protection.

Tax Refund Policy for Overseas

Travelers Departing from China

Travelers Departing from China

@Foreign friends:don’t forget to claim your tax refund when shopping in China.

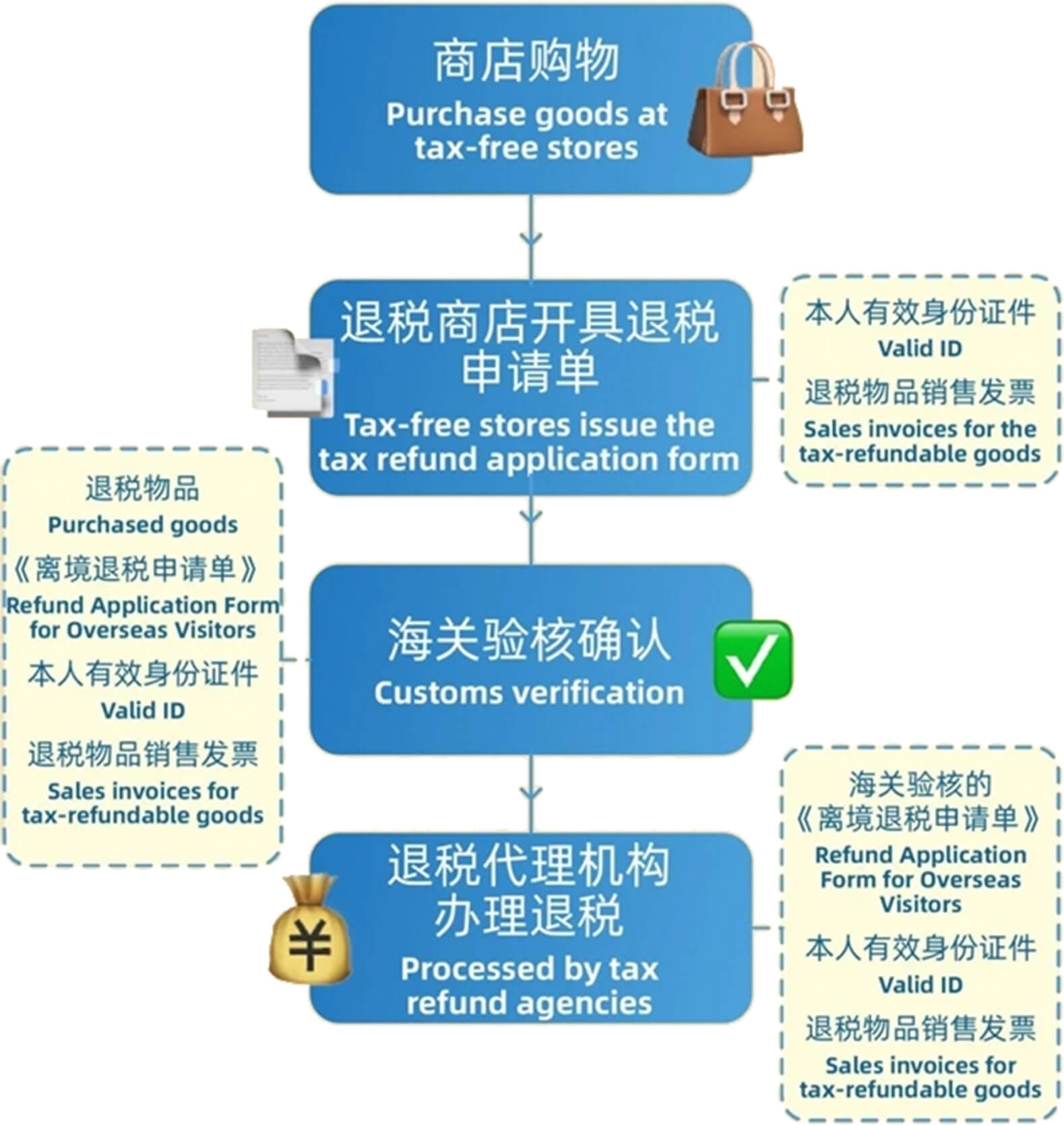

China has recently further optimized its departure tax refund policy for overseas

tourists,offering more stores and products, and making the tax refund process more

convenient.

Questions

Purchases made at stores with the “Tax Free” sign are eligible

for a tax refund upon departure.

Overseas travelers are eligible to apply for a refund if they spend at least

200 yuan (about $27.75) at the same store on the same day and

meet other relevant requirements.

The upper limit for cash refunds has been raised from 10,000 yuan to 20,000

yuan, with no cap on other refund methods.

Amount of the tax refund = sales invoice amount (including VAT) of the tax -

refundable goods x tax refund rate - service fee charged by tax refund agencies

for processing the tax refund.

In accordance with China’s VAT rate,the tax refund rate for general

merchandise is 11%. After deducting service fee, the actual refund

is about 9% of purchased merchandise.

This year, China will significantly expand the implementation of the

“refund-upon-purchase” policy for overseas visitors. While shopping at

designated stores, they can receive their refund on-site after completing a

credit card pre-authorization.

Don’t worry. Recently, China’s Ministry of Commerce and five other departments

issued a notice to expand the coverage of tax-refund stores, providing overseas

visitors with more shopping options.

Various regions are encouraged to establish tax-refund stores in areas with high overseas tourist traffic, such as major shopping areas, pedestrian streets, tourist attractions, resorts, cultural venues, airports, passenger ports, and hotels.

Various regions are encouraged to establish tax-refund stores in areas with high overseas tourist traffic, such as major shopping areas, pedestrian streets, tourist attractions, resorts, cultural venues, airports, passenger ports, and hotels.